|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

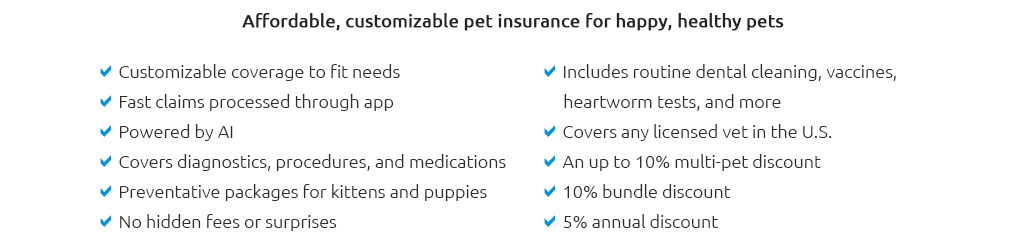

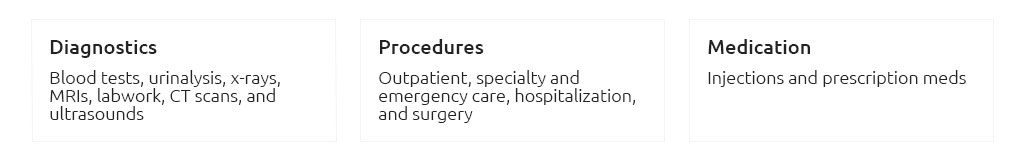

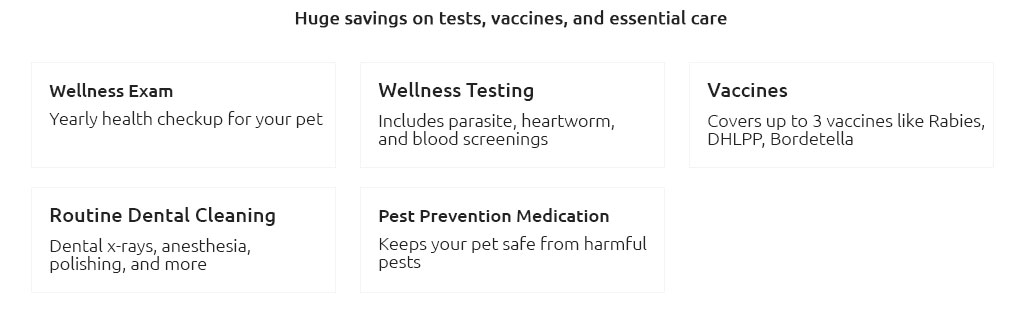

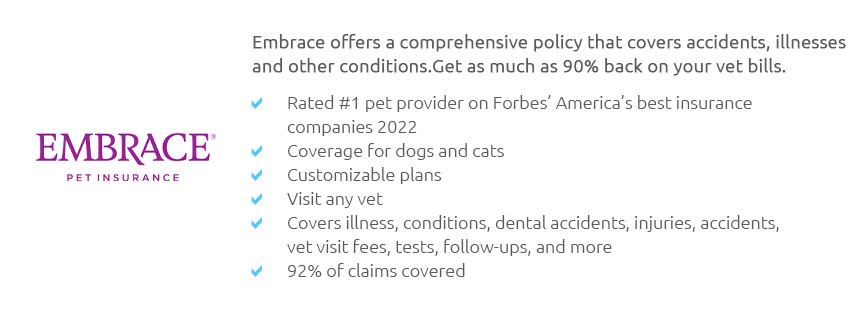

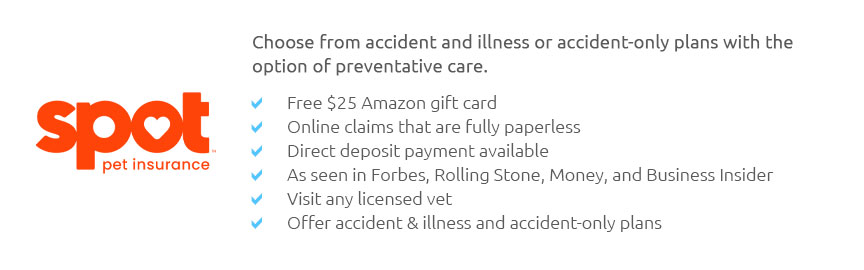

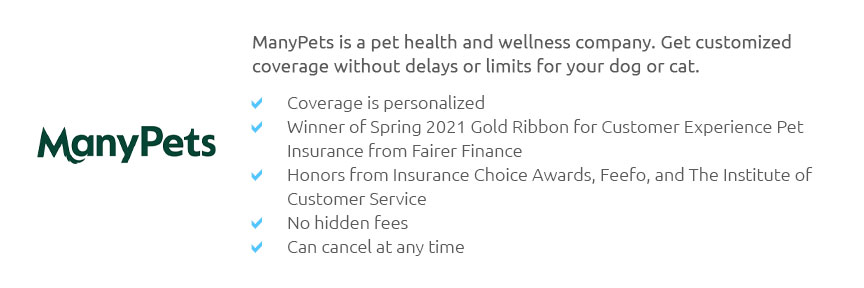

Exploring Pet Insurance Plans in California: Important ConsiderationsAs a state renowned for its progressive stance on numerous issues, California is also at the forefront when it comes to safeguarding the well-being of pets through a variety of insurance plans. With the increasing costs of veterinary care, many pet owners find themselves pondering the necessity and value of pet insurance. The multitude of options available can be overwhelming, but understanding the key considerations can significantly aid in making an informed decision. Firstly, it is crucial to comprehend what pet insurance typically covers. Most plans provide coverage for accidents and illnesses, but routine check-ups and preventive care might not always be included. Therefore, pet owners must scrutinize the policy details meticulously. Some providers offer wellness plans as an add-on, which can be beneficial for regular veterinary visits, vaccinations, and even dental care. This brings us to the importance of evaluating coverage limits and exclusions. Insurance plans may have annual or lifetime limits, and certain conditions might be excluded, particularly pre-existing ones. Thus, a thorough reading of the fine print is paramount. Another vital aspect is the choice between reimbursement models. Pet insurance companies typically offer different reimbursement percentages and deductible options. Some plans reimburse a percentage of the vet bill, while others follow a benefits schedule. Choosing a plan with a higher reimbursement rate might seem appealing, but it often comes with a higher premium. Balancing the monthly cost against potential savings on veterinary expenses is essential. Moreover, consider the flexibility of choosing any licensed veterinarian, as some plans restrict you to a network of providers. Cost-effectiveness is another key consideration. The monthly premium of pet insurance can vary significantly based on factors such as the pet’s age, breed, and location. In California, urban areas like Los Angeles and San Francisco might have higher premiums due to elevated veterinary costs. Hence, it is prudent to obtain multiple quotes and weigh them against the anticipated medical expenses of your pet. It is also worth noting the reputation and reliability of the insurance provider. Researching customer reviews and industry ratings can provide insight into the company’s track record, especially regarding claims processing and customer service. A provider with a history of delayed or denied claims can cause frustration and financial strain during critical moments.

In conclusion, while pet insurance is not an absolute necessity, it offers peace of mind to many Californians who view their pets as family members. The decision to purchase pet insurance should be based on a comprehensive assessment of the pet’s health needs, the owner’s financial situation, and the insurance options available. With thoughtful consideration and a bit of research, California pet owners can find a plan that not only fits their budget but also ensures that their furry companions receive the best possible care. https://www.embracepetinsurance.com/state/pet-insurance-california-ca

Avoid the heat of vet bills with pet insurance in California personalized to your budget with coverage at every neighborhood vet from Sacramento to Los Angeles. http://ucnet.universityofcalifornia.edu/benefits/home-family/pets/

UC offers preferred pricing on pet insurance through Nationwide, providing coverage for accidents and illness. Plans are available for dogs, cats, birds, small ... https://www.fetchpet.com/locations/ca-pet-insurance

Fetch is the most comprehensive pet insurance in California and all of the US. We pay back up to 90% of unexpected vet bills when your pet gets sick or hurt.

|